Minimum Wages

Meghalaya - The Government of Meghalaya Vide. No – LE&SD.9/2023/101 has issued notification regarding revision of minimum wages for scheduled employments with effect from 01st January 2025.

Chandigarh - The Government Vide. No – ST/(CPI)/2024 - 25/38 has issued notification regarding revision of minimum wages for scheduled employments with effect from 1st October 2024 to 31st March 2025.

State Holiday Lists – 2025

Andaman & Nicobar Islands - The Government of Andaman & Nicobar Vide No.F.No.24(1)/2023-24/LC&DET, has issued Notification regarding list of holidays for calendar year 2025.

ESI

Execution of banking agreement with State Bank of India for collection of ESIC contribution on Zero Collection charges basis- reg.

ESIC vide circular no. F-23l13/SBlOnline/2023/A/c-II stated that an agreement was signed on 20.07.2024 between ESIC and SBI for collecting ESIC contributions through various banking channels. It is requested that no charges be levied for transactions as per agreement clause 6.1 from 03.02.2024, and any charges levied since then should be reversed. This is approved by the Competent Authority.

EPFO

Simplification of joint Declaration process – registration

EPFO vide notification no. WSU/Joint Declaration/E-54018/2024-25/006 stated that the Joint Declaration process has been simplified with new classifications for members based on their UAN and Aadhaar linkage. Changes can now be executed at revised levels, and documents can be submitted through Digi-locker or as a single PDF. Employers can file JD requests online for members, including deceased members, and specific guidelines are provided for closed establishments and deceased members.

De-Linking of erroneously linked Member Ids from UAN – reg

EPFO vide circular no. WSU/ErroneousLinkingofUANIE-838432/2024-25/ 10 notified that new facility has been introduced to allow members to delink any erroneously linked Member IDs from their UAN. A detailed User Manual is provided for guidance.

Implementation of Centralised Pension Payment System (CPPS)- Reg

EPFO vide circular no. Pension/V4/CPPS/Pilov2024-Part(1)/efile-948434/2024-25/08 stated that pursuant to the successful pilot run of CPPS in December 2024, all Regional Offices (ROs) will now process pension claims with any bank account from any branch of any scheduled commercial bank in India. This eliminates the need for transfer out of PPOs due to bank branch location or lack of pension disbursement agreements. Pension claims must include accurate IFSC and bank account details to avoid errors. New PPOs require Aadhaar seeding, and existing PPO revisions must be handled by the original issuing RO. Pending tasks from the previous system must be completed promptly. Weekly and monthly pension payment schedules are provided until the full-scale CPPS software is developed. All instructions must be strictly followed, and feedback should be communicated to the Head Office.

Clarification on policy issues related to processing of pension on higher wages cases – reg

EPFO vide circular no. Pension/V1/PoHW/2024-25/efile-951977/09 issued clarifications on processing pensions on higher wages under the Employees’ Pension Scheme (EPS-95). Approved by the Minister of Labour & Employment, these clarifications cover pro-rata pension computation, eligibility for higher wage pensions in exempted establishments, and the handling of pension dues and arrears. Pro-rata pension calculations remain valid, and eligibility in exempted establishments depends on trust rules, excluding amendments post-November 4, 2022. Pension dues must be received before confirming eligibility, and retrospective wage revisions should be accounted for without imposing damages, though interest may be recovered. These clarifications aim to ensure fairness and adherence to EPS-95 regulations.

Paid holiday on February 5 for Delhi Assembly Elections 2025

Haryana

The Haryana government on Sunday (February 2) vide notification no. 28/02/2005 declared a paid holiday in all public offices, academic institutions, boards and corporations on February 5 for the assembly election in Delhi. The holiday will allow employees of the state government who are registered voters of Delhi to exercise their voting rights.

Delhi

The Lieutenant Governor of National Capital Territory of Delhi is vide notification no. 53/729/GAD/CN/2025/255-296 declared Wednesday, the 5th February, 2025 to be a Public Holiday on account of General Election to the Legislative Assembly of Delhi.

Rajasthan

The Government of Rajasthan Vide Serial No.P.12(6)SAPR/2/2023, has released notification Declaration of Statutory Leave for Employees Working in Rajasthan Due to Elections in Delhi on 05th February 2025.

State wise - Notifications

Andhra Pradesh

Declaration of holiday under on the occasion of ‘Kanuma’

Government of Andhra Pradesh vide Notification. No. Rt.73 declare 15.01.2025 as holiday for “Kanuma” under the Negotiable Instruments Act, 1881.

Delhi

PoSH Order dated 6th January 2025

Government of NCT Delhi vide order no. 15(1)/LAB/2025/5379-5381 stated that employers with 10 or more employees must form an Internal Complaint Committee to address sexual harassment, with penalties for non-compliance. Additionally, the Ministry of Women and Child has launched the “She Box Portal” for online complaint registration, and employers are encouraged to register their complaints, if any.

Goa

Goa Factories (Seventeenth Amendment) Rules, 2024

In exercise of the power conferred by Section 112 of the Factories Act, 1948 and all other power enabling it in this behalf, the Government of Goa vide notification no. VI/FAC-6(L-1) Part-1/IFB-23-24/3461 dated 2nd January 2025 notified the Goa Factories (Seventeenth Amendment) Rules, 2024. They shall come into force on the date of their publication in the Official Gazette i.e. 2nd January 2025. Vide amendment several provision regarding license fee, amendment of license has been changed.

Himachal Pradesh

Amendment of BOCW Rules for Women

Government of Himachal Pradesh vide Notification no. LEP-A003/4/2023-Loose notified amendment to the Himachal Pradesh Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Rules, 2008, by inserting a new rule 303 and a new Annexure after Form XLVIII titled Mukhyamantri Widow/ Single/ Destitute/ Divyang Mahila Awas Yojna providing financial assistance of Rs.3,00,000/- towards house construction to eligible women.

Karnataka

Factories Self Certification Scheme

Government of Karnataka vide notification no. LD 80 KBN 2024 has introduced Karnataka State Factories Self Certification Scheme, 2024 to streamline the enforcement of labour laws by promoting voluntary compliance from factory owners. This scheme encourages adherence to key legislations such as the Factories Act, 1948, the Payment of Wages Act, 1936, and the Maternity Benefit Act, 1961. It aims to foster a cooperative environment between workers, management, and the government, ensuring worker rights, safety, and overall welfare while maintaining a peaceful and productive workplace. Participation in this scheme is voluntary. Factory occupiers can opt for certification by submitting a self-declaration to the chief inspector in Form-I, along with a registration fee of Rs. 10,000 and a security deposit of Rs. 50,000. The certificate must be displayed on the factory's notice board or website, and the occupier must comply with all the provisions outlined in the scheme.

Amendment of Karnataka labour welfare fund

Government of Karnataka vide notification no. DPAL 60 SHASANA 2024 amends the Karnataka Labour Welfare Fund Act, 1965. The amendment increases the contribution amounts specified in section 7A from twenty, forty, and twenty rupees to fifty, one hundred, and fifty rupees, respectively. It is effective from the calendar year 2025 and employers are required to deduct contribution of INR 50 from the December 2025 salary of employees.

Kerala

Amendment of Kerala factories’ rules

Government of Kerala vide notification. No. 1/2025/LBR amended the Kerala Factories Rules, 1957 to revise the fees for registration, grant, and renewal of factory licenses. The last revision was made in July 2022, but due to a significant increase in the Department of Factories and Boilers' expenditure, the government decided to update the fees again. This decision aligns with the general revision of user charges and fees for all government services made in July 2024. The amendment aims to address the increased costs of administering the Factories Act, 1948 and providing necessary services to factories.

Meghalaya

Safety and Security Conditions for Employment of Women in Night Shifts in Factories

Government of Meghalaya vide notification no. LE& SD 62/2024/84 outlining conditions for factories seeking to employ women during night shifts (7 PM to 6 AM) under the Factories Act, 1948. Key conditions include ensuring no sexual harassment, providing safety measures for women working alone, compliance with the Sexual Harassment of Women at Workplace Act, 2013, and forming an Internal Committee for addressing harassment issues. Factories must also ensure proper lighting, CCTV coverage, transportation with security measures, and medical facilities. Additionally, women workers must consent to night shifts, and regular workshops on their rights must be conducted. The notification mandates adherence to all relevant labor laws and allows for periodic updates by the government.

Maharashtra

Extension of Due date for LWF Contribution

Government of Maharashtra vide public notice extended the due date for payment of contribution for the half year ending December 3, 2024 from January 15, 2025 to January 31, 2025. Starting June 2024, employees contribute ₹25 and employers ₹75 per employee, half-yearly, making a total of ₹100 per employee.

Tamil Nadu

Revision The Profession Tax Slab Rates for Chennai

The Government of Tamil Nadu, through the Greater Chennai Corporation, vide notification no. PT/SPL/2024 stated regarding the revision of Profession Tax (PT) slab rates, on January 20, 2025. Employers are required to deduct from January 2025 month’s salary of the employees below contribution for II/2024-25 and make the payment before 31-Mar-2025.

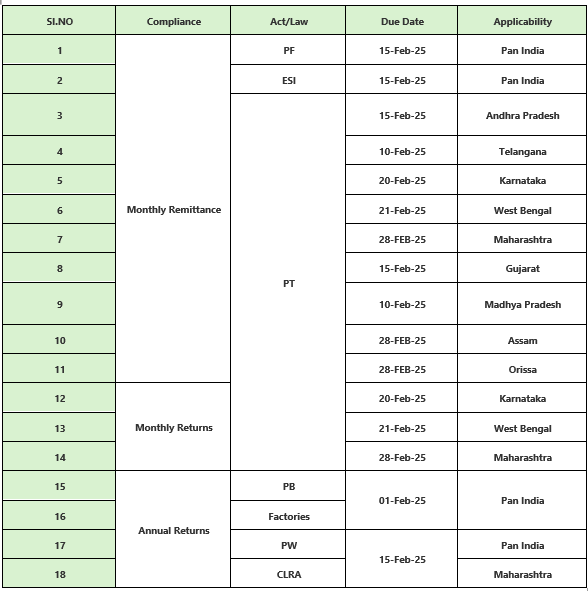

Compliances for the month of February 2025